Bid ask spread formula

A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. Lets say the bid price for a security is 50 per.

Bid Ask Spread Roll Youtube

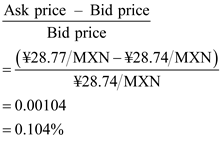

Then the quoted bid-ask spread is.

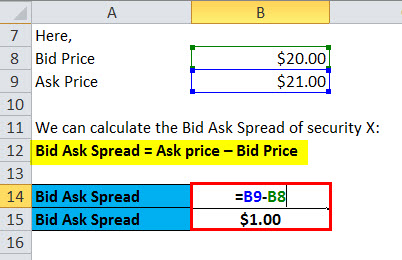

. Bid-Ask Spread Example Calculation. We look at the bid ask spread formula and calculation along with practical examples. More specifically Quoted spread t lowest ask price t highest bid price t.

It is the difference between the highest amount a buyer wishes to pay for an asset and the lowest price that the seller accepts. Also suppose the ask price at order execution was 2548. If you buy 100 shares of a stock with a spread of a penny then the added cost from the spread will be 100 x 001 x 12 or 050.

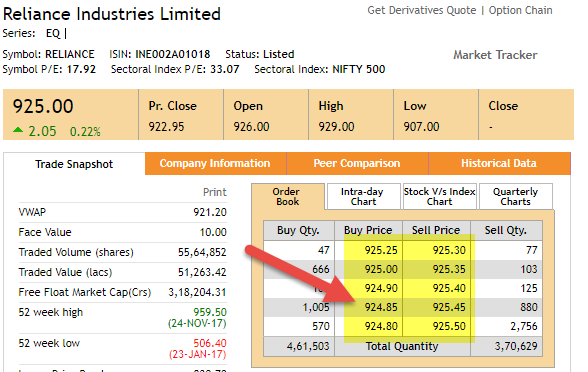

How Market-Makers Set the Bid-Ask Price. It would be the weighted average of the bid price and ask price as adjusted by their respective volumes. The size of the bidask spread in a security is one measure of.

For example if a dealer is willing to sell a certain number of units of a given currency for the equivalent of US150 whereas a trader is only willing to buy a number of the currency units for US100 the midpoint price of the foreign exchange spread. In this video we discuss what is Bid Ask Spread. Effective spread 2 trading price midpoint of market quote at time of order Also it is sometimes expressed as.

The bidask spread also bidoffer or bidask and buysell in the case of a market maker is the difference between the prices quoted either by a single market maker or in a limit order book for an immediate sale and an immediate purchase for stocks futures contracts options or currency pairs in some auction scenario. In foreign currency markets this 4th decimal is. The bid ask spread formula is the difference between the asking price and bid price of a particular investment.

To do that we simply use the spread formula. Where t refers to the t-th trade of some stock during the trading day. Use of the Bid Ask Spread.

Find the bid-ask spread. Investment and Finance has moved to the new domain. Suppose a companys shares are publicly listed on an exchange and trading at 2495.

This is whats called an over the counter OTC market. Effective Bid-Ask Spread Formula. The bid ask spread may be used to determine the liquidity of a particular investment.

So here we have a stock which is offered for sale at Rs3780 and the bid which is received for the same stock is Rs3775 thereby creating a bid ask spread of Rs005. Foreign exchange transactions dont take place on exchanges but rather through networks of forex broker-dealers who make the market. Here the stock will only be bought or sold when the.

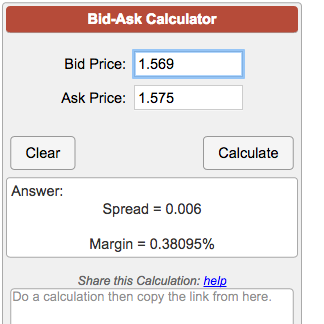

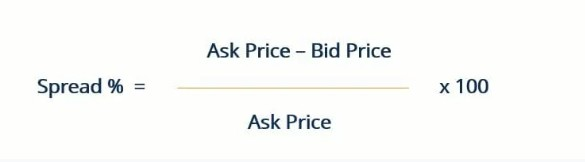

Forexica sells Euro at 13093 and purchases it at 13089. Spread 2 x Ask Bid AskBid x 100. Answer 1 of 3.

Bid-Ask Spread Percentage Formula. 13093 is the sale price so it is the ask. The quoted bid-ask spread is the difference between a market makers a dealers ask and bid price quotes at a given point in time.

Quoted spread t ask price t bid price t. In this tutorial you will learn how to analyze an organizations Bid-Ask Spread and why its an important indicator for identifying how stock purchases and. Moreover the bid-ask spread is typically expressed as a percentage where the spread is compared relative to the asking price.

This gives us a bid-ask spread of 00004 13093 13089 or 4 pips. 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐁𝐢𝐝. Let us work the rather easy formula.

Bid-ask spread is an amount by which the assets ask price is more than the bid price in the market. Bid ask spread 005. The bid-ask spread is essentially the difference between the highest price.

The bid ask spread may be used for various investments and is primarily used in investments that sell on an exchange. Take Your Options Trading to the Next Level with Innovative Tools Educational Resources. Bid ask spread Ask price bid price.

In equation form it is given by. Bid-Ask Spread Ask Price Bid Price Ask Price. The effective bid-ask spread is the difference between the price at which a dealer or a market maker buys sells a securityinvestment and the price at which the dealer subsequently sells buys it.

This bid-ask spread formula is affected. It can be calculated by adding the ask and bid prices and then dividing the sum by two. Effective spread 2 transaction price mid price Suppose the quoted bid and ask prices were 2545 and 2550 respectively.

For a larger transaction of 1000 shares on a stock with a bid. 13089 is the purchase price and hence the bid. If the bid and ask volumes are identical then you can disregard the volume.

It can be understood as a measure of the supply and demand for an asset.

Solved Chapter 4 Problem 5p Solution Multinational Finance 4th Edition Chegg Com

Bid Ask Spread Calculator Find Formula Check Example More

/GettyImages-525348438-0cdffe67f1574eb39c2c3b3a949b058e.jpg)

How To Calculate The Bid Ask Spread

Bid Ask Calculator

How To Calculate Spread Fox Business

What Is A Bid Ask Spread Youtube

Bid Ask Spread Formula Step By Step Bid Ask Spread Calculation

Bid Ask Spread Formula And Percentage Calculation Example

How Can We Calculate The Foreign Exchange Spread Fasapay Information Center

Bid Ask Spread Formula And Percentage Calculation Example

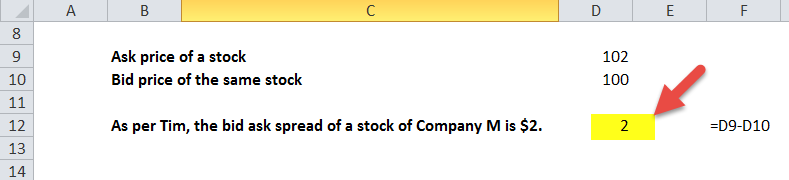

Bid Ask Spread Formula Calculator Excel Template

Bid Ask Spread Formula Step By Step Bid Ask Spread Calculation

Bid Ask Spread Prepnuggets

Forex Spread What Is The Spread In Forex And How Do You Calculate It

Solved This Is The Formula Of Bid Ask Price Spread In Chegg Com

Bid Ask Spread Formula Step By Step Bid Ask Spread Calculation

Bid Ask Spread Formula Calculator Excel Template