Salary calculator plus overtime

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

Wage Calculator Convert Salary To Hourly Pay

48 x 15 720.

. Some companies pay 25 times the standard rate for overtime and sometimes even more. Calculate the overtime pay which. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as.

An employer may choose a higher rate of overtime pay. First enter your current payroll information and deductions. You cant withhold more than your earnings.

Dont forget that this is the minimum figure as laid down by law. Then enter the hours you expect to. Depending on the employer and its incentive policy the overtime multiplier may be greater than the laws limit and so there are cases where companies pay double time 25 times the regular pay rate or even triple or quadruple times.

Then enter the employees gross salary amount. Calculate the overtime pay which is the number of overtime hours x the overtime hourly rate. Ad Create professional looking paystubs.

Regular pay of 15 8 hours 120. A non-workman earning up to 2600. 1500 per hour x 40 600 x 52 31200 a year.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. Your estimated --take home pay. Ad In a few easy steps you can create your own paystubs and have them sent to your email.

1000154 1500 4 6000. There is no limit in the Act on the number of hours employees aged. Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages.

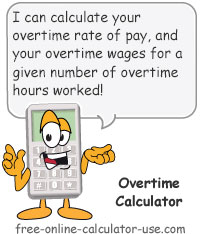

Overtime Hours per pay period Dismiss. Calculate your regular and overtime wages. In the first section you can input your monthly salary and have the calculator break down your weekly salary and hourly rate.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. 35 hours x 12 10 hours x 15 570 base pay 570 45 total hours 1267 regular rate of pay 1267 x 05 634 overtime premium rate 634 x 5 overtime hours 3170 total overtime premium pay. Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay.

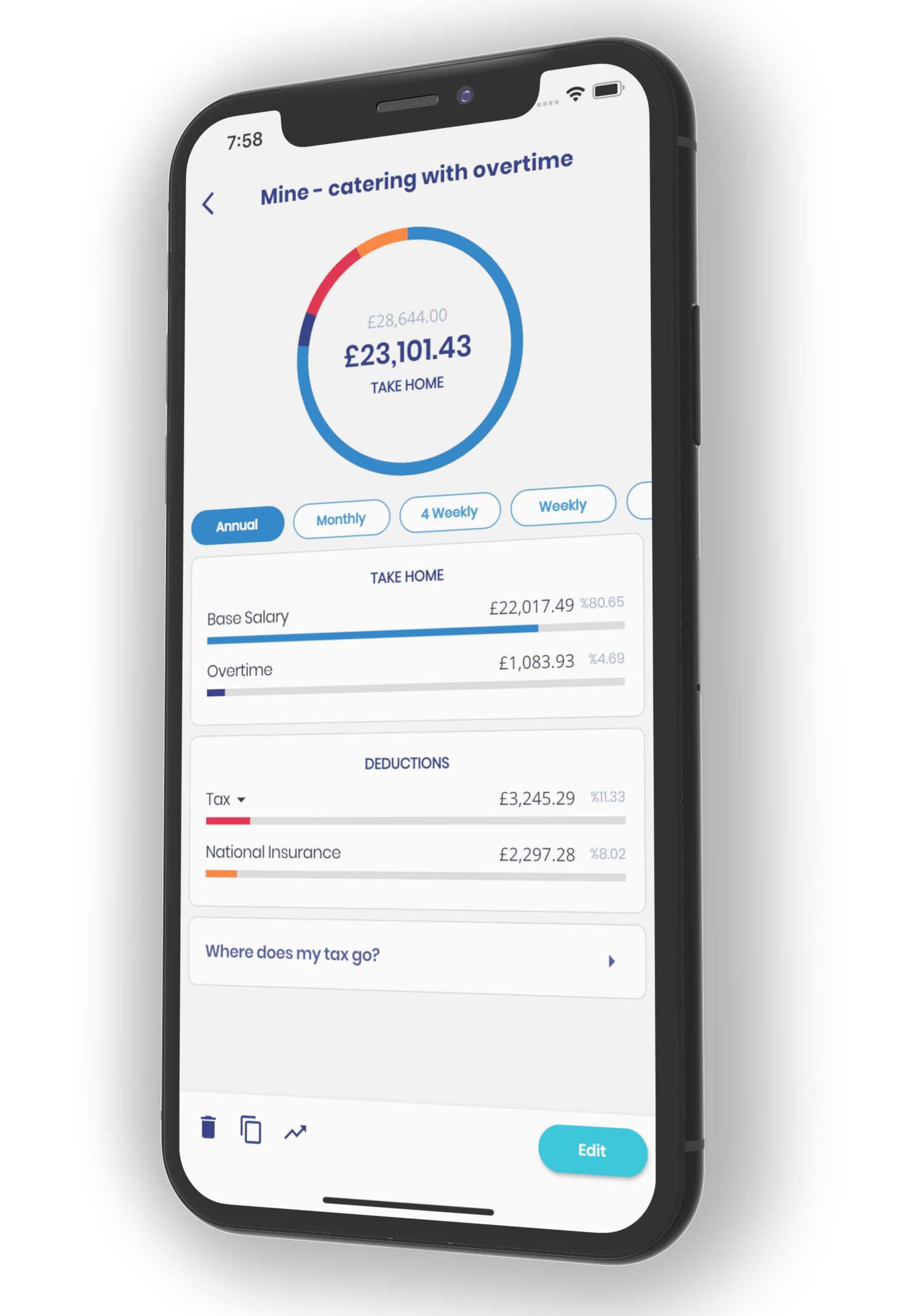

This law includes nonexempt employees who are paid hourly salary and those who are paid on piece rate. Wage for the day 120 11250 23250. Add your overtime rate while calculating the overtime payment.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Anything less than 40 hours a week would result in a lower overall pay total on time worked. Thats where our paycheck calculator comes in.

GetApp has the Tools you need to stay ahead of the competition. We use the most recent and accurate information. Overtime pay of 15 5 hours 15 OT rate 11250.

C alculate the standard weekly pay for Victoria which is the number of regular hours x the standard hourly rate. California overtime law requires employees to receive twice their regular pay when more than 12 hours. Exempt means the employee does not receive overtime pay.

An employer is required to pay their employees one and one-half times their regular rate of pay for all hours over 8 hours in a workday and over 40 hours in a workweek. Ad See the Employee Time Calculator Tools your competitors are already using - Start Now. Due to the nature of hourly wages the amount paid is variable.

The FLSA requires that covered nonexempt employees in the United States be paid at least the Federal minimum wage for all hours worked and receive overtime pay at one and one-half times the employees regular rate of pay for all hours worked after 40 hours of work in a workweek. The regular rate is calculated by dividing the total pay for employment except for the statutory. A workman earning up to 4500.

Overtime work is all work in excess of your normal hours of work excluding breaks. For the cashier in our example at the hourly wage of 1500 per hour a cashier would have to work 40 hours a week to make 600. GET Salaried Overtime Calculator Using the same numbers from the earlier section you can see how this calculator helps you see your overtime pay and at the same time calculates your hourly rate.

Please adjust your. This employees total pay due including the overtime premium for the workweek can be calculated as follows. Create professional looking paystubs.

Most employees receive their overtime with their regular salary payment. 30 8 260 62400. 8000 6000 14000.

If you expect the. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Overtime Pay Calculators

Excel Formula Basic Overtime Calculation Formula

Hourly To Salary What Is My Annual Income

4 Ways To Calculate Annual Salary Wikihow

Pay Raise Calculator

Overtime Calculator

Overtime Calculator To Calculate Time And A Half Rate And More

Salary Calculator App

Overtime Calculator Workest

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Excel

How To Calculate Payroll For Hourly Employees Sling

Overtime Pay Calculators

Overtime Calculation Wage Mathematics Salary Png 1000x1093px Overtime Area Blue Brand Calculation Download Free

Hourly To Salary Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com